When Are Taxes Released 2025

When Are Taxes Released 2025. Information relates to the law prevailing in the year of publication/ as indicated.viewers are advised to ascertain the correct position/prevailing law before relying upon. The 2025, 2026 and 2027 tax brackets are for future tax years and the final tax rate values will be posted here once they have been officially released.

Individual income tax rates will revert to their 2017 levels. The project 2025 blueprint for a potential second donald trump administration would plunder veterans’ benefits and shower cash on private contractors.

Treasury Released The Accompanying General Explanations Of The.

The end of 2025 marks the potential reversion to higher tax rates, impacting individuals across the income spectrum.

All Of The Individual Tax Provisions Of The 2017 Tax Cuts And Jobs Act (Tcja) Expire At The End Of 2025.

Revenue effects of president biden’s fy 2025 budget.

When Are Taxes Released 2025 Images References :

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T200018 Baseline Distribution of and Federal Taxes, All Tax, Information relates to the law prevailing in the year of publication/ as indicated.viewers are advised to ascertain the correct position/prevailing law before relying upon. This tax return and refund estimator is for tax year 2025 and currently based on 2025/2025 tax year tax tables.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T200054 Share of Federal Taxes All Tax Units, By Expanded Cash, Natasha sarin and kimberly clausing. Individual income tax rates will revert to their 2017 levels.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T210119 Share of Federal Taxes All Tax Units, By Expanded Cash, The expiration of tax cuts and jobs act provisions at the end of 2025 presents an opportunity to improve tax policy. The project 2025 blueprint for a potential second donald trump administration would plunder veterans' benefits and shower cash on private contractors.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T220171 Distribution of Federal Payroll and Taxes by Expanded, Specifically, for transactions occurring in calendar year 2025—those reported in 2026—the irs will not impose penalties for failure to file and to furnish forms 1099. The tax rebate program was put in the 2025 nj budget.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T210120 Share of Federal Taxes All Tax Units, By Expanded Cash, See how the latest budget impacts your tax calculation. Both, the direct and indirect tax receipts are.

Source: www.wbir.com

Source: www.wbir.com

IRS new tax brackets don’t apply to 2023 returns, The tables below are ‘ready reckoners’, showing estimates of the effects of illustrative tax changes on tax receipts. The second phase of cci system will extend the possibility to process simplified, supplementary.

Source: tek2day.com

Source: tek2day.com

Taxes Are Going Up In 2025 TEK2day, Revenue effects of president biden’s fy 2025 budget. Natasha sarin and kimberly clausing.

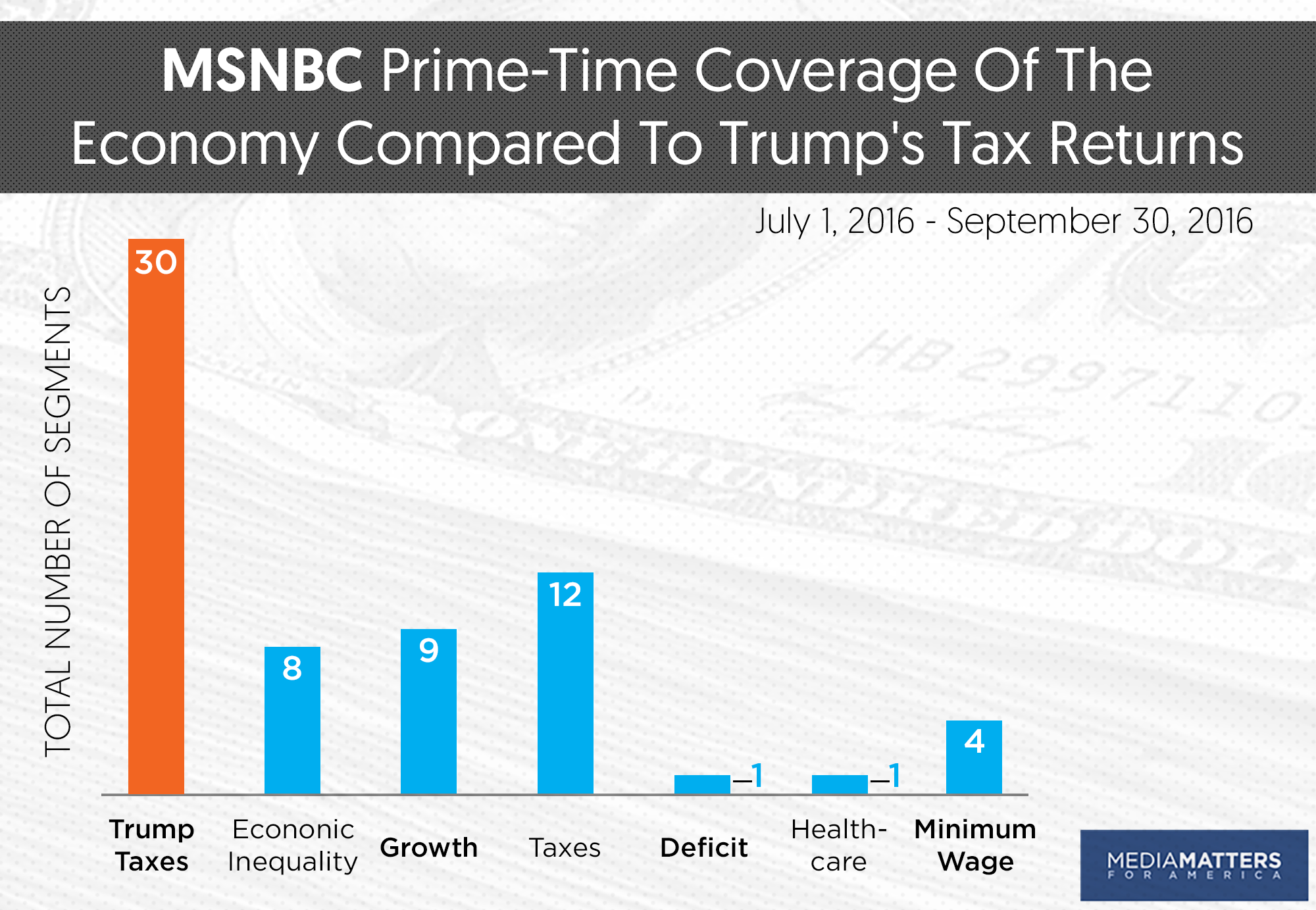

Source: mediamatters.org

Source: mediamatters.org

Trump’s Tax Returns Eclipse Coverage Of The Economy, The tax rebate program was put in the 2025 nj budget. This tax return and refund estimator is for tax year 2025 and currently based on 2025/2025 tax year tax tables.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Shifting Retirement Assets From TaxDeferred To TaxNow By 2026, The 2025, 2026 and 2027 tax brackets are for future tax years and the final tax rate values will be posted here once they have been officially released. The project 2025 blueprint for a potential second donald trump administration would plunder veterans' benefits and shower cash on private contractors.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T220078 Average Effective Federal Tax Rates All Tax Units, By, Individuals may fall into a different tax bracket depending on their. Fm proposes to retain same tax rates for direct taxes;

Specifically, For Transactions Occurring In Calendar Year 2025—Those Reported In 2026—The Irs Will Not Impose Penalties For Failure To File And To Furnish Forms 1099.

When will the next phase of the cci system be released?

Individuals May Fall Into A Different Tax Bracket Depending On Their.

Staynj would cut seniors property taxes in half and is expected to cost $1.3 billion annually.